Harnessing the Potential of ArcGIS for Future Land Value Tax Reforms: Case from Pittsburgh, Detroit, and Hawaii

- jingzhuang

- Aug 13, 2025

- 4 min read

Economists have long advocated for land value tax as an efficient form of taxation since it only taxes the land but not the buildings sitting on top of it, therefore, it encourages economic development and curbs land speculation. Later, this tax form evolved as the two-rate property tax, or split-rate tax, which applied higher rates to land than to structures, promoting better land use.

As concerns grow regarding land use inefficiencies, land value taxes, and local property tax statutes, ArcGIS Earth has become crucial for integrated visualization. It has significantly influenced land value tax reforms in three keyways:

Enabling comprehensive analysis, evaluation, and visualization of geographic data.

Supporting the systematic monitoring and assessment of local government policy implementations.

Improving transparency of geographic information and policy processes, fostering greater public engagement and participation.

Some cities in the United States have adopted or are about to adopt this split tax rate model. For instance, Pittsburgh, Detroit, and Hawaii, as shown in the Figure 1 below:

Figure 1: Project Geospatial Locations, Including Detroit, Pittsburgh and Hawaii

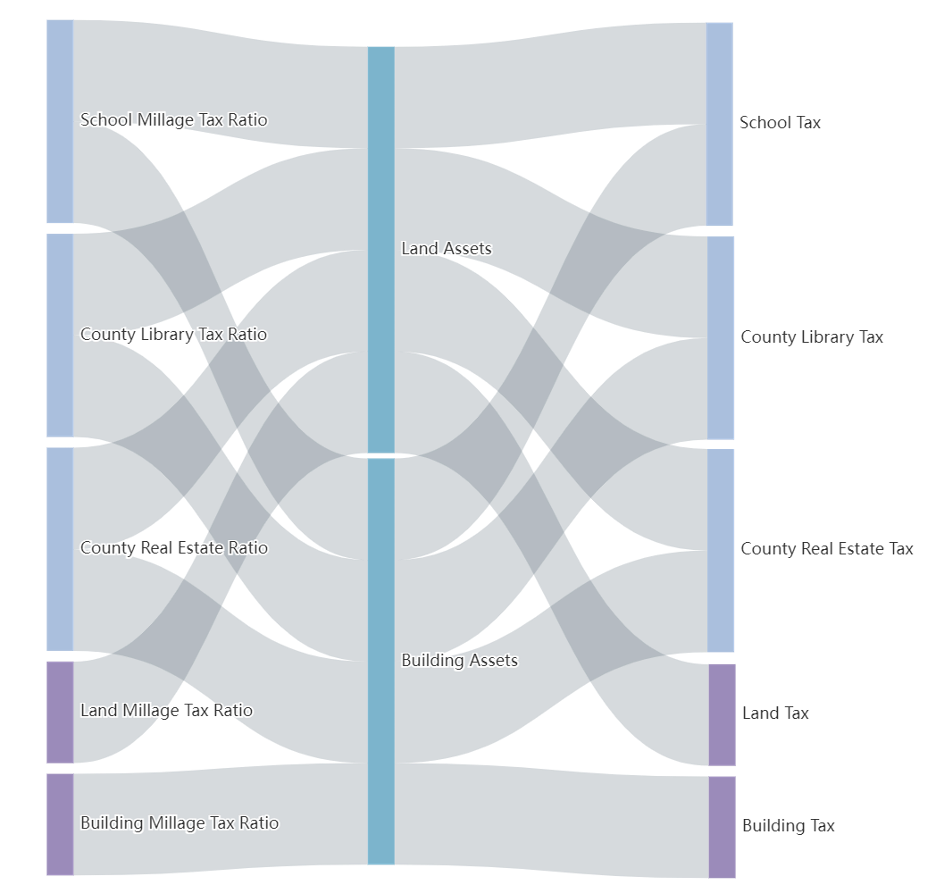

In many of the cases, a property is taxed by various taxing authorities such as school, municipality, county real estate, and county library. Each of these authorities has its own specific tax or millage rate.

In the split rate tax case, since land and buildings are taxed differently, they will also have distinct tax rates. Therefore, the total property tax would be calculated as the millage rate multiply the taxable value. See Table 1 below:

Table 1: property tax calculation

Millage Rate | Taxable Value |

School | Land + Building |

County Real Estate | Land + Building |

County Library | Land + Building |

Land | Land |

Building | Building |

Figure 2: Split Tax Rate Calculation Method: Different Types Of Millage Tax Ratio (MTR) Multiplied By The Sum Of The Corresponding Value

Summarizing and organizing all the data is a complex task that involves statistics, geographic visualization, 3D image presentation, and ensuring a user-friendly query process.

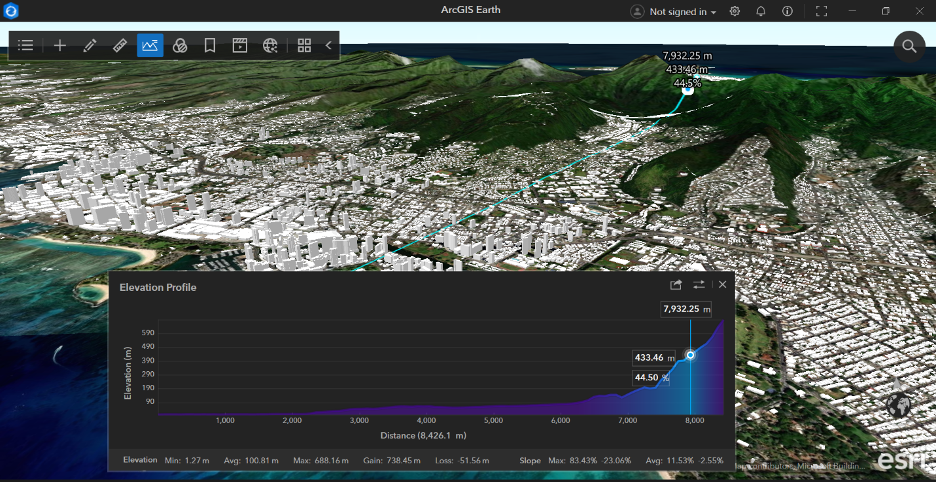

ArcGIS Earth is a free, easy-to-use geographic information system (GIS) software developed by Esri, designed to help users visualize and interact with geographic data in a 3D environment. Functions include but are not limited to 3D visualization, data support, labeling and annotation, layer management, measurement, geographic analysis, sharing and exporting, cross-software integration, etc.

Figure 3: Land and Building Tax Value Visualization in ArcGIS Earth System

Figure 4: ArcGIS Earth Digital Twins Model Tool for Smart City

The following section explores and compares conventional property tax, land value tax, and split-rate tax, providing a historical overview of their implementation in the United States, with a focus on the City of Pittsburgh, the City of Detroit, and the State of Hawaii. GIS Earth shows promising potential to enhance data analysis and policy implementation history for land value tax reforms, aiming to boost transparency, public engagement, and the overall fairness and effectiveness of tax policies.

CITY OF PITTSBURGH

Pittsburgh, Pennsylvania's largest city, adopted a split-rate tax system in 1913, imposing higher taxes on land than on improvements. The tax rate on land was significantly increased between 1979 and 1980. GIS and GIS Earth 3D offer substantial potential to refine and enhance tax policy effectiveness in Pittsburgh. Modern GIS technology provides insights into their long-term impacts by visualizing and tracking historical tax changes. For the record about varying taxable value and tax rates of different cities in Pennsylvania from 1980 to 1990, with the GIS system, GIS Earth 3D technology can illustrate these trends, demonstrating how tax policies influence urban development. In ArcGIS Earth, Pittsburgh experienced a 70.43% increase in the annual average number of building permits between 1980 and 1990, in contrast to a decline in 14 other cities, ranging from -11.54% to -66.99%. The ongoing integration of GIS could result in more robust and transparent urban tax assessments, facilitating more equitable and effective reforms in the future.

STATE OF HAWAII

Hawaii adopted a statewide split-tax system in 1963, aiming to support tourism by taxing land more heavily than improvements. This policy contributed to a surge in hotel construction. However, due to complications in the legislation and local opposition to rapid urban changes, particularly at Waikiki Beach, the law was rescinded in 1977. Following the rescission, the authority to levy property taxes was transferred to Hawaii's four counties in 1978. Since then, counties like Kauai have adopted unique practices, such as taxing improvements more than land. GIS Earth has been vital in managing these tax reforms timely, providing real-time updates, and aiding in the post-disaster economic recovery. These tools have ensured that tax policies are aligned with current market conditions, improving transparency and the scientific basis for policy decisions.

CITY OF DETROIT

Detroit's property tax system came under scrutiny in 2010 when properties in low-value neighborhoods were discovered to be taxed on assessments drastically higher than their sale prices, highlighting systemic over-assessment issues. In response, proposed House Bills 4966-70 suggest a new land value tax plan aimed at reducing property taxes for homeowners by an average of 17% while increasing them on abandoned buildings and vacant lots. This proposal, if passed, would significantly alter Detroit's tax landscape, cutting the tax rate on improvements from 20 mills to 6 mills and more than doubling the rate on land. GIS Earth enables simulations of different tax scenarios and visualizes their potential impacts. These tools help decision-makers and the public understand the effects of the proposed tax changes, facilitating more informed discussions and decisions regarding urban policy and development.

ArcGIS Earth significantly enhances the tax rate statistics process through several key aspects: it provides robust decision support by loading comprehensive data and accurately assisting in infrastructure management, improves work efficiency by reducing data silos, promotes information exchange and communication, and integrates presentation content to simplify operations.

To facilitate public participation, simplified geographic models and environmental information are used to communicate the vision of community planning more effectively and clearly. This approach helps establish a foundation of trust for transparent governance and future public involvement, thereby enhancing the development of smart cities and the rationality of urban management.

Comments